We are often asked about the benefits, and how to set up direct debit payment automation, and how you can work even more efficiently by using direct debit in an integrated ServiceM8 workflow.

But what does integrated direct debit mean, and how can service companies better integrate within their job management systems.

If you use GoCardless already, you will know that it automates cash collection by taking payments from your customers. each time payment is due, with a single upfront mandate. Making cash flow more predictable for your business with integrated direct debit payments combined with the tools you use every day to build and manage your customers.

GoCardless, for example, integrates with all the major accounting and billing platforms like Xero and QuickBooks, as well as subscription and CRM platforms like Salesforce. So why bother with integrated direct debit:

- It will save you a huge amount of time on reconciliation. If you use standalone direct debit you’ll have to manually reconcile every payment against invoices and bank statements with integrated direct debit, you can automatically match transactions and review these against your statement with a simple click.

- With integrated direct debit, you will have real time payment updates, without having to check your bank account. This allows you to take action quickly against any payments that have not been collected and better manage the problem of late payment.

- Finally, it reduces the chance of human error and keying mistakes as your payment data is updated automatically.

All this will improve the quality of your reporting and means less time spent on sorting out mistakes.

So, to sum up, direct debit automated payment is a payment workflow that can easily integrate with the tools you use every day. By connecting it with these tools you can save time on reconciliation, act quickly when payments fail or mandates are canceled, and reduce the risk of errors during data entry.

To find out more about integrating GoCardless with ServiceM8 and Xero – visit the GoCardless partner web page.

ServiceM8 removes administration and paperwork headaches from trade and service businesses. However, when it comes to taking regular payments on, say, a monthly basis – unless it is set up well – time saving benefits from the admin side can be lost by pushing the work towards finance and accounting work and problems.

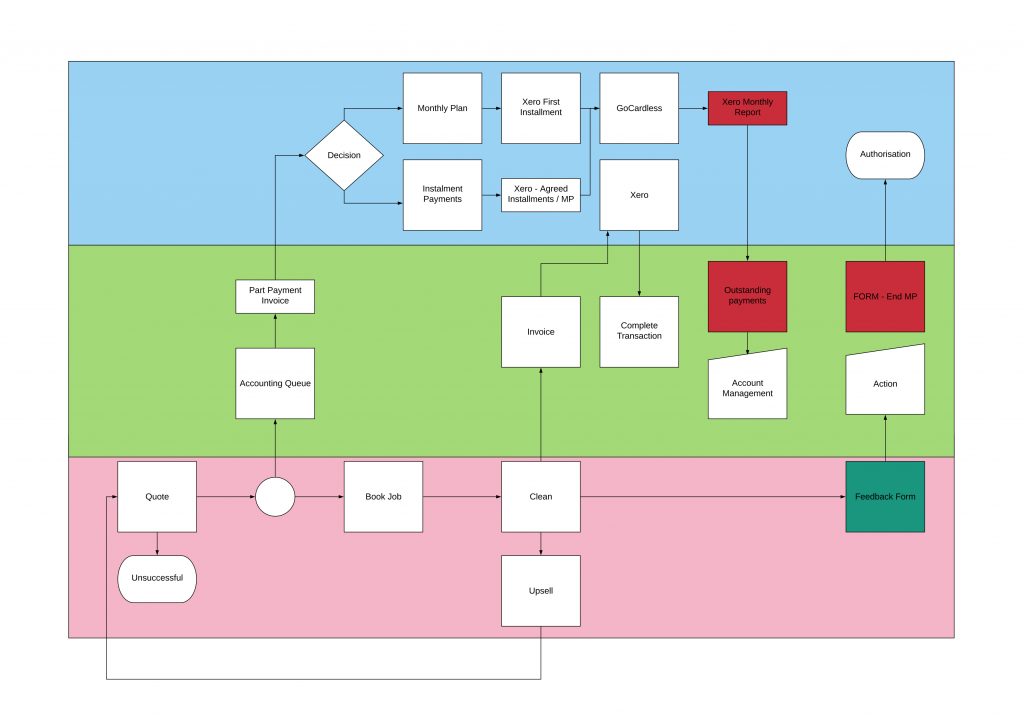

Workflow diagram below, to see how: part payment installments; and integrated direct debit payments can be managed – and importantly, how any missed direct debits are managed and reported to the operations team so that it delivers the best customer service/experience – without upsetting business or finance departments.

If you would like to learn how we are helping service companies utilise direct debit payment automation, make more money, with reduced admin and wasted time, simply schedule a short call at your convenience.